Finance as individual as you are

Honda Finance Europe Plc trading as Honda Financial Services, is part of the Honda Motor Company, so no one is better placed to provide you with the most appropriate, convenient and flexible funding solution for getting you into your new Honda motorcycle.

Honda's finance products are as flexible and versatile as our Motorcycles, so speak to your local Honda dealer about your monthly budget and they'll explain the benefits of finance solutions that include Personal Contract Purchase (PCP), Hire Purchase (HP) and Restricted Use Loan (RUL)

Personal Contract Purchase (PCP)

Personal Contract Purchase is a finance product offered by Honda Financial Services that provides a flexible funding solution to get you on your new motorcycle and out on the road with monthly payments that are lower than some alternative finance products.

How it works

PCP typically offers a lower monthly payment than Hire Purchase. This is because we defer part of your loan repayment until the end of the agreement, when you will then have three options.

So, how does this work?

- Firstly, choose the motorcycle you want, and agree how much deposit you would like to put down.

- Then, estimate how many miles you will ride each year, and then agree how long you would like your agreement to run, between two and four years.

- Then, estimate how many miles you will ride each year

- We will then use this information to calculate a Guaranteed Future Value [GFV] – this is what we predict the value of your motorcycle to be worth at the end of the agreement.

- The Guaranteed Future Value is deferred until the end of your agreement.

- Because this value is based on your estimated annual mileage, it is important to give an accurate estimate, as you may have to pay excess mileage charges if you exceed your total agreed mileage for the agreement.

- Your monthly payments are worked out on the difference between the GFV and the price of the motorcycle once your deposit has been taken off and interest added. This means you have lower, fixed monthly repayments than with Hire Purchase.

You decide

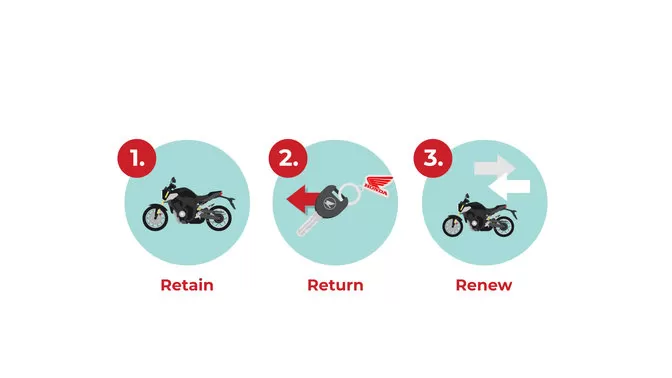

At the end of your agreement you have the flexibility of 3 options:

- Retain - You can keep your motorcycle – pay the final payment and the option to purchase fee, and you will own the motorcycle outright, or...

- Return - You can hand your motorcycle back to us without paying the final payment – if you have exceeded your agreed mileage or the motorcycle is not in a good condition, then there may be additional charges to pay. Excess mileage charges will be explained before you sign the agreement, so you will know what these may be if you go over your estimated mileage.And finally your third option is...

-

Renew - You can part exchange your motorcycle and subject to market value conditions, this should cover off the cost of the final payment. Then together with your Honda dealer, you can start looking for your next Honda.

Choose the right product

Personal Contract Purchase may not be right for you so please review our other finance products or speak to your Honda dealer, to make sure you choose the right product to suit your needs.

It is important that the product you choose should provide a monthly payment that is sustainable, whilst also meeting your needs and circumstances best. Your Honda dealer will be happy to assist you with this.

Product Features and Considerations

There are some aspects of Personal Contract Purchase (PCP) that you need to be aware of to help you make an informed choice to decide if PCP is right for you.

- As your PCP agreement includes a Guaranteed Future Value (GFV) you have the ability to return the motorcycle to us (subject to the terms of the agreement). This provides you with some protection from market depreciation.

- You have the right to withdraw from your PCP agreement within 14 days from the start of your agreement. You can also partially or fully settle your agreement at any time (subject to the terms of the agreement).

Personal Contract Purchase (PCP) may not be the right product for you for the following reasons:

- If you are a high annual mileage user then PCP is unlikely to be suitable for you as there is a maximum total contracted mileage limit.

- If you prefer to change your motorcycle after more than 4 years then PCP may not be right for you as the maximum PCP term is 4 years.

- Interest is payable on the amount you borrow including the Guaranteed Future Value (GFV). The Total Amount Payable (the overall cost) is likely to be higher than a Hire Purchase agreement with the same loan amount and term, as your balance will reduce slower due to the deferred GFV.

- If you do more miles than you estimated and/or there is damage to the motorcycle, there may be additional charges if you decide to return your car to us.

- You are not guaranteed to have any equity at the end of the agreement, if market conditions mean your motorcycle is worth less than the GFV. This may mean you will require an additional deposit if you choose to part exchange at the end of the agreement.

- You will own the motorcycle outright once all regular payments, GFV and any option to purchase fees are paid.

Hire Purchase (HP)

Hire Purchase is the simplest and most straightforward way Honda Financial Services can help you to fund your new Honda motorcycle. Interest rates and monthly payments remain fixed throughout the full term of the Hire Purchase agreement, and as soon as the final payment has been made the motorcycle is all yours.

More manageable than you might think

So, how does this work?

- Choose the motorcycle you want, and agree how much deposit you’d like to put down.

- The rest of the cost of the motorcycle, plus interest, is paid in equal monthly payments.

- Before you start your agreement, you can adjust the term to best suit your ideal monthly budget, from anywhere between one and five years.

- Once you’ve paid all the monthly payments and the option to purchase fee, you own the motorcycle.

Choose the right product

Hire Purchase may not be right for you so please review our other finance products or speak to your Honda dealer, to make sure you choose the right product to suit your needs.

It is important that the product you choose should provide a monthly payment that is sustainable, whilst also meeting your needs and circumstances best. Your Honda dealer will be happy to assist you with this.

Product Features and Considerations

- There are some aspects of Hire Purchase (HP) that you need to be aware to help you make an informed choice to decide if HP is right for you.

- There are no mileage restrictions as part of the finance agreement.

- The Total Amount Payable (overall cost) is typically lower than PCP on an agreement over the same term.

- You have the right to withdraw from your HP agreement with 14 days from the start of your agreement. You can also partially or fully settle your agreement at any time (subject to the terms of the agreement).

- With Hire Purchase there is no deferred payment amount (the Guaranteed Future Value or GFV) so you may pay more a month compared to PCP

- Because there is no GFV, you have less protection against depreciation than with a PCP

- You will not own the motorcycle outright until all regular payments and any option to purchase fees are paid.

- To keep monthly payments down, you may need to take your loan over a longer term

No Pressure Selling

When you visit our motorbike dealerships, you won't be subject to any high pressure, pushy sales techniques. Our teams are there to help you make an informed decision. Relax, take your time and ask us all the questions you want answers to.

Restricted Use Loan (RUL)

Restricted Use Loan is a finance product from Honda Financial Services to help finance accessories, clothing or even your new Honda bike. It allows you take ownership of the goods from the start of your agreement.

So, how does this work?

- Choose the motorcycle, clothing and accessories you want.

- Once you’ve decided what products you would like to finance, agree how much deposit you’d like to put down.

- You can then adjust the term to best suit your ideal monthly budget, anywhere between twelve and sixty months.

- The rest of the cost of the motorcycle, clothing or accessories, plus interest, is paid in equal monthly payments.

- A Restricted Use Loan provides you with instant ownership of the goods, as you can use the funds to purchase them. You then pay all the agreed loan instalments until the loan value and interest has been paid in full.

There are some aspects of Restricted Use Loan that you need to be aware of to help you make an informed choice to decide if RUL is right for you.

Choose the right product

Restricted Use Loan may not be right for you so please review our other finance products or speak to your Honda dealer, to make sure you choose the right product to suit your needs.

It is important that the product you choose should provide a monthly payment that is sustainable, whilst also meeting your needs and circumstances best. Your Honda dealer will be happy to assist you with this.

Product Features and Considerations

There are some aspects of Restricted Use Loan (RUL) that you need to be aware to help you make an informed choice to decide if HP is right for you.

- If you use our RUL to fund your motorcycle, there are no mileage limits as part of the finance agreement.

- If you use our RUL to fund your motorcycle, the Total Amount Payable (overall cost) is likely to be lower than PCP on an agreement over the same term.

- You have the right to withdraw from your RUL agreement within 14 days from the start of your agreement. You can also partially or fully settle your agreement at any time (subject to the terms of the agreement).

- You take ownership (title) of any goods purchased with the loan at the start of the agreement, not when you make the final payment. Unlike a PCP or HP agreement, our RUL is not secured against the motorcycle.

- If applicable, clothing and accessories not linked to the motorcycle can be included or funded separately using our RUL Product.

- RUL may be more suitable for funding your motorcycle if you plan to use the motorcycle for delivery work and are not eligible for our Hire Purchase or Personal Contract Purchase products.

Thunder Road Motorcycles Ltd (FCA Number 584111), is an Appointed Representative of Automotive Compliance Ltd, who is authorised and regulated by the Financial Conduct Authority (FCA No 497010). Automotive Compliance Ltd’s permissions as a Principal Firm allows Thunder Road Motorcycles Ltd to act as a credit broker, not as a lender, for the introduction to a limited number of lenders and to act as an agent on behalf of the insurer for insurance distribution activities only.

Part of Completely Motoring Ltd (FCA Number 676043),

We can introduce you to a selected panel of lenders, which includes manufacturer lenders linked directly to the franchises that we represent. An introduction to a lender does not amount to independent financial advice and we act as their agent for this introduction. Our approach is to introduce you first to the manufacturer lender linked directly to the particular franchise you are purchasing your vehicle from, who are usually able to offer the best available package for you, taking into account both interest rates and other contributions. If they are unable to make you an offer of finance, we then seek to introduce you to whichever of the other lenders on our panel is able to make the next best offer of finance for you. Our aim is to secure the best deal you are eligible for from our panel of lenders. Lenders may pay a fixed commission to us for introducing you to them, calculated by reference to the vehicle model or amount you borrow. Different lenders may pay different commissions for such introductions, and manufacturer lenders linked directly to the franchises that we represent may also provide preferential rates to us for the funding of our vehicle stock and also provide financial support for our training and marketing. But any such amounts they and other lenders pay us will not affect the amounts you pay under your finance agreement, all of which are set by the lender concerned. If you ask us what the amount of commission is, we will tell you in good time before the Finance agreement is executed. All finance applications are subject to status, terms and conditions apply, UK residents only, 18’s or over. Guarantees may be required.